The siren song of emerging tokens in the cryptocurrency market is undeniable. While established giants like Bitcoin and Ethereum offer a narrative of relative stability and institutional adoption, the altcoin space represents the wild, untamed frontier of digital assets—a place where life-changing gains are promised in Telegram groups and on crypto Twitter, often within absurdly short timeframes. This relentless hype cycle creates a perpetual tension for investors: the allure of short-term gains versus the pursuit of genuine long-term value. Navigating this landscape requires more than just luck; it demands a disciplined strategy to separate the ingenious from the fraudulent, the transformative from the transient. This article delves into the high-stakes world of emerging tokens, analyzing the inherent risks of “pump-and-dump” schemes, outlining strategies for identifying long-term potential, and examining case studies of projects that successfully made the leap from obscure token to established winner.

The Perpetual Threat: Identifying and Avoiding “Pump-and-Dump” Risks

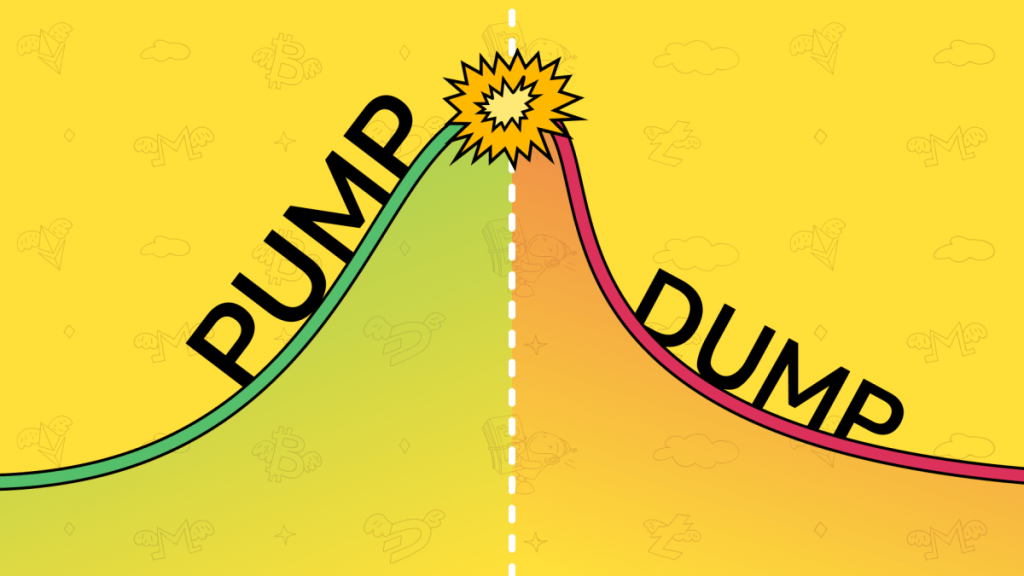

For every legitimate project, there are countless others designed with a single purpose: to separate retail investors from their capital through coordinated manipulation. The “pump-and-dump” scheme is the quintessential scam of the crypto world, and emerging tokens are its primary hunting ground. Understanding its mechanics is the first line of defense.

The Anatomy of a Pump-and-Dump:

The scheme typically unfolds in distinct phases, often orchestrated within private Discord or Telegram channels.

- Accumulation: The orchestrators (or “insiders”) identify a low-market-cap, low-liquidity token. This could be a completely meaningless token created in minutes or a seemingly legitimate project with weak fundamentals. They accumulate a large position at rock-bottom prices before any hype begins.

- The Pump: The orchestrated campaign of misinformation launches. This involves coordinated posting across social media platforms, YouTube “technical analysis” videos from paid shills, and messages in public channels touting the token as the “next 100x gem.” Narratives are fabricated around fake partnerships, baseless technological breakthroughs, or celebrity endorsements. The goal is to create a fever pitch of FOMO (Fear Of Missing Out).

- The Peak and Dump: As a wave of retail investors floods in, buying based on this manufactured hype, the price skyrockets. The insiders, watching their portfolios multiply, begin to sell their holdings into this artificial demand. Because their holdings are so large relative to the token’s liquidity, their selling pressure overwhelms the market.

- The Collapse: The price plummets as the insiders exit. The retail investors who bought at the peak are left “holding the bag,” watching their investment evaporate within minutes or hours. The social channels go silent, the shills move on to the next project, and the token chart is left with a massive, irreversible spike—a monument to the scam.

Red Flags and How to Spot Them:

Investors can protect themselves by cultivating a healthy sense of skepticism and watching for these glaring warning signs:

- Anonymous Teams: A project whose developers and leaders are completely anonymous presents zero accountability. If the project fails or is exposed as a scam, they face no reputational damage.

- Excessive Hype and Secrecy: Beware of channels that promise “alpha” or “guaranteed gains” if you act now. Legitimate projects build value through development progress and utility, not through paid shilling and pressure tactics.

- Unrealistic Returns and Guarantees: Promises of specific, massive returns are a hallmark of fraud. Crypto is inherently volatile and unpredictable; no one can guarantee profits.

- Low Liquidity and High Ownership Concentration: Use blockchain explorers like Etherscan to check token distribution. If a vast majority of the tokens are held by a few wallets, it is a clear sign that the price can be easily manipulated by those holders.

- Vague Whitepapers and Roadmaps: A legitimate project has a detailed, technical whitepaper explaining its technology and a clear, achievable roadmap. Scam projects feature copied text, grandiose claims with no technical substance, and roadmap milestones that are purely marketing-focused (e.g., “CEX listings” rather than “mainnet launch”).

Building a Moat: Strategies for Uncovering Long-Term Potential Picks

While avoiding scams is crucial, the real goal is to identify the tiny fraction of emerging tokens that possess genuine long-term potential. This requires a fundamental shift in mindset from speculator to investor, focusing on rigorous research and analysis.

1. Fundamental Analysis: Looking Beyond the Hype

This is the cornerstone of long-term investing. It involves a deep dive into the project’s core value proposition.

- The Problem and Solution: What specific, real-world problem is this project trying to solve? Is the problem significant enough to warrant a blockchain-based solution? Is their solution actually better, more efficient, or more decentralized than existing alternatives (both crypto and traditional)?

- The Team: Who are the founders, developers, and advisors? Do they have proven experience in blockchain development, cryptography, or the specific industry they are targeting? Are they public and engaged with the community, demonstrating a long-term commitment?

- The Technology: This is the hardest but most important part. Read the whitepaper. Do you understand the consensus mechanism, the tokenomics, and the architectural design? Is the code open-source and available on GitHub? Is there active development and regular commits from the developers?

- Tokenomics and Utility: This is critical. What is the function of the native token? Is it absolutely essential to the network’s operation (e.g., used for gas fees, staking to secure the network, governance)? Or is it merely a speculative asset with no inherent utility? Analyze the supply schedule: is there a high, inflationary emission rate that will constantly pressure the price, or is the supply capped or deflationary? How are the tokens distributed? A fair launch with a large portion allocated to the community is a positive sign.

2. Market Analysis: Understanding the Competitive Landscape

No project exists in a vacuum.

- Total Addressable Market (TAM): How big is the market the project is targeting? A project solving a niche issue in a multi-billion dollar industry has more room to grow than one in a small, saturated market.

- Competitive Advantage (Moat): What does this project do that its competitors cannot easily replicate? This could be technological innovation, first-mover advantage, a strong brand, or strategic partnerships.

- Community Strength: A strong, organic, and engaged community is a powerful asset. Look beyond the number of followers to the quality of discussion. Are people talking about the technology and use cases, or just the price?

3. The Dollar-Cost Averaging (DCA) Mindset

Even after thorough research, investing in emerging tokens remains highly speculative. Mitigate risk by avoiding going “all-in” at one price. Allocate only a small portion of your overall portfolio to these high-risk assets and consider building a position slowly over time, regardless of short-term price fluctuations. This discipline prevents emotional decision-making and reduces the impact of volatility.

Lessons from the Frontlines: Case Studies of Early Winners

History provides the best lessons. Examining projects that delivered both monumental short-term gains and sustained long-term value reveals common patterns of success.

Case Study 1: Ethereum (ETH) – The Proto-Winner

While now a legacy coin, Ethereum was once the ultimate emerging token. Its 2014 ICO raised around $18 million, with ETH priced at roughly $0.30.

- The Long-Term Value Thesis: Ethereum’s proposition was not just a new coin; it was a programmable blockchain. It solved a fundamental problem: Bitcoin’s lack of scripting flexibility for complex applications. Its utility was undeniable from the start—it was the foundational platform for smart contracts and dApps.

- Why It Succeeded: It had a visionary founder (Vitalik Buterin), a technologically innovative whitepaper, and a clear, massive use case that created its own ecosystem. The token, ETH, was intrinsically necessary to power every operation on the network (gas fees). Its success was built on utility and network effect, not hype.

Case Study 2: Chainlink (LINK) – Solving a Critical Need

Chainlink launched in 2017, addressing a crucial infrastructure problem in the nascent smart contract ecosystem: the “oracle problem.” Smart contracts on-chain cannot access external data; they need oracles to feed them real-world information.

- The Long-Term Value Thesis: Chainlink provided decentralized, tamper-proof oracle networks. Its value was directly tied to the growth and security of the entire DeFi and smart contract space. The more smart contracts that needed reliable data, the more demand there was for LINK tokens, which are used to pay node operators.

- Why It Succeeded: It identified a critical, unmet infrastructure need and built a best-in-class solution. It formed strategic partnerships with major companies and blockchain projects early on, embedding itself as the industry standard. Its tokenomics directly tied the token’s value to the network’s usage.

Case Study 3: The “Meme Coin” Paradox: Dogecoin (DOGE) & Shiba Inu (SHIB)

These cases are fascinating outliers that highlight the power of narrative and community, albeit with extreme risk.

- Short-Term Gains: Both generated unprecedented short-term returns driven entirely by social media hype, celebrity endorsements (most notably Elon Musk), and a powerful community-driven “meme” culture.

- The Long-Term Value Question: Their fundamental value proposition is weak or non-existent. Their value is almost purely derived from speculation and brand recognition. While both have attempted to build utility (e.g., Shiba Inu’s Shibarium layer-2), their primary driver remains sentiment. They serve as a potent reminder that in the short term, the market can remain irrational longer than investors can remain solvent. Investing in them is not based on traditional fundamentals but on gauging cultural trends—a far riskier proposition.

Conclusion: Navigating the High-Risk, High-Reward Divide

The world of emerging tokens is a dichotomy of immense opportunity and profound risk. The potential for short-term gains is real but is often a mirage created by bad actors. The path to sustainable long-term value is less glamorous, requiring diligent research, patience, and a focus on fundamental utility over hype.

The key for any investor is to define their goals and risk tolerance clearly. Allocating a small, speculative portion of one’s portfolio to emerging tokens based on solid fundamental research can be a rational strategy. However, chasing green candles based on anonymous Twitter tips is a proven recipe for loss. The question is not whether a token can pump, but whether it has the foundational strength to build and hold value long after the pumps have faded. In the end, the greatest investment one can make is in the time it takes to understand the technology before investing a single dollar.